Quantity theory of money

In monetary economics, the quantity theory of money is the theory that money supply has a direct, proportional relationship with the price level.

The theory was challenged by Keynesian economics,[1] but updated and reinvigorated by the monetarist school of economics. While mainstream economists agree that the quantity theory holds true in the long run, there is still disagreement about its applicability in the short run. Critics of the theory argue that money velocity is not stable and, in the short-run, prices are sticky, so the direct relationship between money supply and price level does not hold.

Alternative theories include the real bills doctrine and the more recent fiscal theory of the price level.

Contents |

Origins and development of the quantity theory

The quantity theory descends from Copernicus,[2] followers of the School of Salamanca, Jean Bodin,[3] and various others who noted the increase in prices following the import of gold and silver, used in the coinage of money, from the New World. The “equation of exchange” relating the supply of money to the value of money transactions was stated by John Stuart Mill[4] who expanded on the ideas of David Hume.[5] The quantity theory was developed by Simon Newcomb,[6] Alfred de Foville,[7] Irving Fisher,[8] and Ludwig von Mises[9] in the latter 19th and early 20th century, and was argued against by Karl Marx.[10] The theory was influentially restated by Milton Friedman in response to Keynesianism.[11]

Academic discussion remains over the degree to which different figures developed the theory.[12] For instance, Bieda argues that Copernicus's observation

Money can lose its value through excessive abundance, if so much silver is coined as to heighten people's demand for silver bullion. For in this way, the coinage's estimation vanishes when it cannot buy as much silver as the money itself contains […]. The solution is to mint no more coinage until it recovers its par value.[12]

amounts to a statement of the theory,[13] while other economic historians date the discovery later, to figures such as Jean Bodin, David Hume, and John Stuart Mill.[12][14]

Historically, the main rival of the quantity theory was the real bills doctrine, which says that the issue of money does not raise prices, as long as the new money is issued in exchange for assets of sufficient value.[15]

Equation of exchange

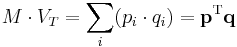

In its modern form, the quantity theory builds upon the following definitional relationship.

where

is the total amount of money in circulation on average in an economy during the period, say a year.

is the total amount of money in circulation on average in an economy during the period, say a year. is the transactions velocity of money, that is the average frequency across all transactions with which a unit of money is spent. This reflects availability of financial institutions, economic variables, and choices made as to how fast people turn over their money.

is the transactions velocity of money, that is the average frequency across all transactions with which a unit of money is spent. This reflects availability of financial institutions, economic variables, and choices made as to how fast people turn over their money. and

and  are the price and quantity of the i-th transaction.

are the price and quantity of the i-th transaction. is a column vector of the

is a column vector of the  , and the superscript T is the transpose operator.

, and the superscript T is the transpose operator. is a column vector of the

is a column vector of the  .

.

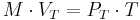

Mainstream economics accepts a simplification, the equation of exchange:

where

is the price level associated with transactions for the economy during the period

is the price level associated with transactions for the economy during the period is an index of the real value of aggregate transactions.

is an index of the real value of aggregate transactions.

The previous equation presents the difficulty that the associated data are not available for all transactions. With the development of national income and product accounts, emphasis shifted to national-income or final-product transactions, rather than gross transactions. Economists may therefore work with the form

where

is the velocity of money in final expenditures.

is the velocity of money in final expenditures. is an index of the real value of final expenditures.

is an index of the real value of final expenditures.

As an example,  might represent currency plus deposits in checking and savings accounts held by the public,

might represent currency plus deposits in checking and savings accounts held by the public,  real output (which equals real expenditure in macroeconomic equilibrium) with

real output (which equals real expenditure in macroeconomic equilibrium) with  the corresponding price level, and

the corresponding price level, and  the nominal (money) value of output. In one empirical formulation, velocity was taken to be “the ratio of net national product in current prices to the money stock”.[16]

the nominal (money) value of output. In one empirical formulation, velocity was taken to be “the ratio of net national product in current prices to the money stock”.[16]

Thus far, the theory is not particularly controversial, as the equation of exchange is an identity. A theory requires that assumptions be made about the causal relationships among the four variables in this one equation. There are debates about the extent to which each of these variables is dependent upon the others. Without further restrictions, the equation does not require that a change in the money supply would change the value of any or all of  ,

,  , or

, or  . For example, a 10% increase in

. For example, a 10% increase in  could be accompanied by a 10% decrease in

could be accompanied by a 10% decrease in  , leaving

, leaving  unchanged. The quantity theory postulates that the primary causal effect is an effect of M on P.

unchanged. The quantity theory postulates that the primary causal effect is an effect of M on P.

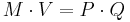

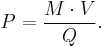

A rudimentary version of the quantity theory

The equation of exchange can be used to form a rudimentary version of the quantity theory of the effect of monetary growth on inflation.

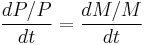

If  and

and  were constant, then:

were constant, then:

and thus

where

is time.

is time.

That is to say that, if  and

and  were constant, then the inflation rate (the rate of growth

were constant, then the inflation rate (the rate of growth  of the price level) would exactly equal the growth rate

of the price level) would exactly equal the growth rate  of the money supply. In short, the inflation rate is a function of the monetary growth rate.

of the money supply. In short, the inflation rate is a function of the monetary growth rate.

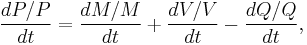

Less restrictively, with time-varying V and Q, we have the identity

which says that the inflation rate equals the monetary growth rate plus the growth rate of the velocity of money minus the growth rate of real expenditure. If one makes the quantity theory assumptions that, at least in the long run, (i) the monetary growth rate is controlled by the central bank, (ii) the growth rate of velocity is purely determined by the evolution of payments mechanisms, and (iii) the growth rate of real expenditure is determined by the rate of technological progress plus the rate of labor force growth, then while the inflation rate need not equal the monetary growth rate, an x percentage point rise in the monetary growth rate will result in an x percentage point rise in the inflation rate.

Cambridge approach

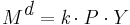

Economists Alfred Marshall, A.C. Pigou, and John Maynard Keynes (before he developed his own, eponymous school of thought) associated with Cambridge University, took a slightly different approach to the quantity theory, focusing on money demand instead of money supply. They argued that a certain portion of the money supply will not be used for transactions; instead, it will be held for the convenience and security of having cash on hand. This portion of cash is commonly represented as k, a portion of nominal income ( ). The Cambridge economists also thought wealth would play a role, but wealth is often omitted for simplicity. The Cambridge equation is thus:

). The Cambridge economists also thought wealth would play a role, but wealth is often omitted for simplicity. The Cambridge equation is thus:

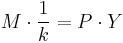

Assuming that the economy is at equilibrium ( ),

),  is exogenous, and k is fixed in the short run, the Cambridge equation is equivalent to the equation of exchange with velocity equal to the inverse of k:

is exogenous, and k is fixed in the short run, the Cambridge equation is equivalent to the equation of exchange with velocity equal to the inverse of k:

The Cambridge version of the quantity theory led to both Keynes's attack on the quantity theory and the Monetarist revival of the theory.[17]

Quantity theory and evidence

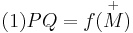

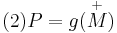

As restated by Milton Friedman, the quantity theory emphasizes the following relationship of the nominal value of expenditures  and the price level

and the price level  to the quantity of money

to the quantity of money  :

:

The plus signs indicate that a change in the money supply is hypothesized to change nominal expenditures and the price level in the same direction (for other variables held constant).

Friedman described the empirical regularity of substantial changes in the quantity of money and in the level of prices as perhaps the most-evidenced economic phenomenon on record.[18] Empirical studies have found relations consistent with the models above and with causation running from money to prices. The short-run relation of a change in the money supply in the past has been relatively more associated with a change in real output  than the price level

than the price level  in (1) but with much variation in the precision, timing, and size of the relation. For the long-run, there has been stronger support for (1) and (2) and no systematic association of

in (1) but with much variation in the precision, timing, and size of the relation. For the long-run, there has been stronger support for (1) and (2) and no systematic association of  and

and  .[19]

.[19]

Principles

The theory above is based on the following hypotheses:

- The source of inflation is fundamentally derived from the growth rate of the money supply.

- The supply of money is exogenous.

- The demand for money, as reflected in its velocity, is a stable function of nominal income, interest rates, and so forth.

- The mechanism for injecting money into the economy is not that important in the long run.

- The real interest rate is determined by non-monetary factors: (productivity of capital, time preference).

Decline of money-supply targeting

An application of the quantity-theory approach aimed at removing monetary policy as a source of macroeconomic instability was to target a constant, low growth rate of the money supply.[20] Still, practical identification of the relevant money supply, including measurement, was always somewhat controversial and difficult. As financial intermediation grew in complexity and sophistication in the 1980s and 1990s, it became more so. As a result, some central banks, including the U.S. Federal Reserve, which had targeted the money supply, reverted to targeting interest rates. But monetary aggregates remain a leading economic indicator.[21] with "some evidence that the linkages between money and economic activity are robust even at relatively short-run frequencies."[22]

Criticisms

John Maynard Keynes criticized the quantity theory of money in The General Theory of Employment, Interest and Money. Keynes had originally been a proponent of the theory, but he presented an alternative in the General Theory. Keynes argued that price level was not strictly determined by money supply. Changes in the money supply could have effects on real variables like output.[1]

Ludwig von Mises agreed that there was a core of truth in the Quantity Theory, but criticized its focus on the supply of money without adequately explaining the demand for money. He said the theory "fails to explain the mechanism of variations in the value of money".[23]

See also

- Classical dichotomy

- Demand for money

- Equation of exchange

- Income velocity of money

- Liquidity preference

- Monetae cudendae ratio

- Monetarism

- Monetary inflation

- Monetary policy

- Neutrality of money

Alternative theories

- Benjamin Anderson (critic of mainstream variant)

- Fiscal theory of the price level

- Real bills doctrine

References

- ^ a b Minksy, Hyman P. John Maynard Keynes, McGraw-Hill. 2008. p.2.

- ^ Nicolaus Copernicus (1517), memorandum on monetary policy.

- ^ Jean Bodin, Responses aux paradoxes du sieur de Malestroict (1568).

- ^ John Stuart Mill (1848), Principles of Political Economy.

- ^ David Hume (1748), “Of Interest,” "Of Interest" in Essays Moral and Political.

- ^ Simon Newcomb (1885), Principles of Political Economy.

- ^ Alfred de Foville (1907), La Monnaie.

- ^ Irving Fisher (1911), The Purchasing Power of Money,

- ^ von Mises, Ludwig Heinrich; Theorie des Geldes und der Umlaufsmittel [The Theory of Money and Credit]

- ^ Capital Vol III, Chapter 34

- ^ Milton Friedman (1956), “The Quantity Theory of Money: A Restatement” in Studies in the Quantity Theory of Money, edited by M. Friedman. Reprinted in M. Friedman The Optimum Quantity of Money (2005), pp. 51-67.

- ^ a b c Volckart, Oliver (1997), "Early beginnings of the quantity theory of money and their context in Polish and Prussian monetary policies, c. 1520-1550", The Economic History Review 50 (3): 430–449, doi:10.1111/1468-0289.00063

- ^ Bieda, K. (1973), "Copernicus as an economist", Economic Record 49: 89–103, doi:10.1111/j.1475-4932.1973.tb02270.x

- ^ Wennerlind, Carl (2005), "David Hume's monetary theory revisited", Journal of Political Economy 113 (1): 233–237

- ^ Roy Green (1987), “real bills dcctrine”, in The New Palgrave: A Dictionary of Economics, v. 4, pp. 101-02.

- ^ Milton Friedman, and Anna J. Schwartz, (1965), The Great Contraction 1929–1933, Princeton: Princeton University Press, ISBN 0-691-00350-5

- ^ Froyen, Richard T. Macroeconomics: Theories and Policies. 3rd Edition. Macmillan Publishing Company: New York, 1990. p. 70-71.

- ^ Milton Friedman (1987), “quantity theory of money”, The New Palgrave: A Dictionary of Economics, v. 4, p. 15.

- ^ Summarized in Friedman (1987), “quantity theory of money”, pp. 15-17.

- ^ Friedman (1987), “quantity theory of money”, p. 19.

- ^ NA (2005), How Does the Fed Determine Interest Rates to Control the Money Supply?”, Federal Reserve Bank of San Francisco. February,[1]

- ^ R.W. Hafer and David C. Wheelock (2001), “The Rise and Fall of a Policy Rule: Monetarism at the St. Louis Fed, 1968-1986”, Federal Reserve Bank of St. Louis, Review, January/February, p. 19.

- ^ Ludwig von Mises (1912), “The Theory of Money and Credit (Chapter 8, Sec 6)”.

Further reading

- Friedman, Milton (1987 [2008]). “quantity theory of money”, The New Palgrave: A Dictionary of Economics, v. 4, pp. 3–20. Abstract. Arrow-page searchable preview at John Eatwell et al.(1989), Money: The New Palgrave, pp. 1–40.

- Laidler, David E.W. (1991). The Golden Age of the Quantity Theory: The Development of Neoclassical Monetary Economics, 1870-1914. Princeton UP. Description and review.

- Mises, Ludwig Heinrich Edler von; Human Action: A Treatise on Economics (1949), Ch. XVII “Indirect Exchange”, §4. “The Determination of the Purchasing Power of Money”.

External links

- The Quantity Theory of Money from John Stuart Mill through Irving Fisher from the New School

- “Quantity theory of money” at Formularium.org — calculate M, V, P and Q with your own values to understand the equation

- How to Cure Inflation (from a Quantity Theory of Money perspective) from Aplia Econ Blog